About Smarter Graduate

We Want to Help Everyone Make Smarter College & Career Choices

Why We Started

Though college is one of the biggest financial investments most will ever make, there wasn’t a single online tool that gave a full and accurate picture of how your degree and student loans would impact your financial future.

Why We Exist

Smarter Graduate’s sole purpose is to help students, career changers, counselors, and ISDs get the data needed to make the smartest choices when it comes to college, careers, and student loans. We want to help you plan for a financially secure future.

Why It Matters

Choosing the wrong career, taking out loans you won’t be able to pay back, or gaining a degree you cannot use can devastate your finances and take decades to recover from. Make the right choice the first time with Smarter Graduate.

Students

Student loans can follow you forever (even through bankruptcy), Smarter Graduate makes sure you understand:

What you are paying for.

How long you will be paying for it.

How much you will ultimately pay for it.

What the return on your investment will truly be.

Don’t think student loans are that big of a deal? See the stats.

$1.6T

$1.6 trillion in total student debt

44.7M

44.7 million Americans with student loan debt

$2.8K

$2.8k student debt accrued every second

70%

70% of college students take on debt

$30K+

$30,000+ average student debt

30%

30% of student loan borrowers are deferring their loans

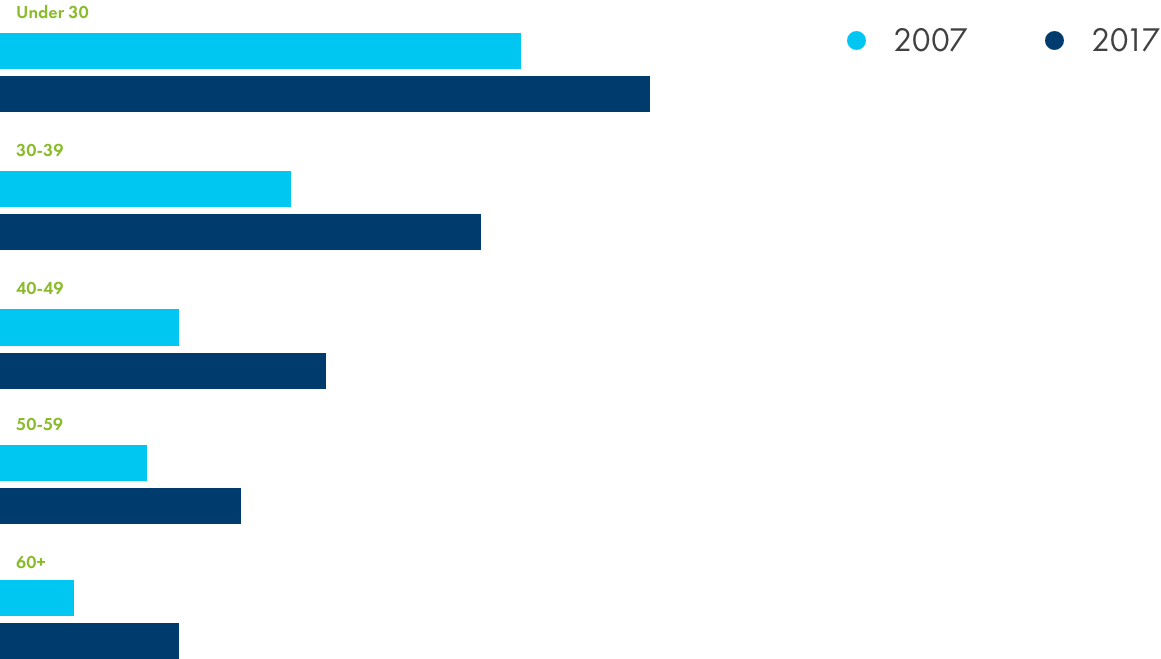

Total Student Loan Debt by Age

While borrowers under 30 have the most debt, consumers in the next two age groups – 30 to 49 – saw the largest increase in debt. These age groups are often considered the ‘buying power’ groups in the US, yet their student debt is growing faster than any other segment! Borrowers over 50 have seen increased student debt as well, with a large jump for those over 60 who potentially returned to school for a new career or second degree.

Source: New York Fed Consumer Credit Panel, Equifax

Average Total Debt of Graduates Who Took Out Loans

According to the Federal Reserve, over two-thirds of young adults who went to college in 2018 took on debt. About 69% of students from the Class of 2018 took out student loans, graduating with an average debt balance hovering around $30,000. As of 2019, more than 42 million student loan borrowers have student loan debt of up to $100,000.

Career-changers

Career changes are a huge lifetime event. Don’t make yours without seeing what it means for your financial future.

30% of the workforce will change careers or jobs every twelve months.

The average person will change careers 5-7 times during

their working life

Most people change their careers about every 3 years

80% of people are not happy in their current job

See exactly when you will break even with your new career

You’ll break even when you’re

35

Years old

Career Advisors & Schools

Help your students and clients gain the knowledge necessary for their future financial success.

Help your students or clients plan for:

- Degree fields by comparing multiple degree options

- Total student debt, including the full amount they will pay and when it will be paid off

- Career choices and income, as well as industry information

- Career changes, and when they will break even in their new career

Contact Smarter Graduate

Please contact us at [email protected] or using the form below with any questions, and we’ll get back to you within 24 hours.